IN recent months, discussions about a new tax law in Nigeria have caused growing concern among citizens across the country. From traders to civil servants and small shop owners, many Nigerians are worried about how government tax policies may affect their daily lives. A major fear is the belief that Nigerians will now be taxed each time they withdraw money from their bank accounts.

This concern has spread quickly through WhatsApp messages, radio discussions, and social media posts. Unfortunately, much of the information being shared is incomplete or incorrect. To understand the reality, it is important to explain what is actually happening in clear and simple language.

There is currently no new law in Nigeria that taxes people simply for withdrawing their own money from their bank accounts. What many Nigerians are experiencing are existing charges that have been misunderstood or poorly explained.

One major source of confusion is the Electronic Money Transfer Levy. This levy has been in place since 2022. It requires banks to deduct fifty naira on electronic transfers of ten thousand naira and above. For example, when a trader in Onitsha sends money from their phone to a supplier in Aba, the bank may deduct this charge once for that transaction. It does not apply to cash withdrawals made over the counter at a bank.

Another charge people often complain about is stamp duty. This is also fifty naira on certain electronic transactions above ten thousand naira. If a parent in Ibadan transfers school fees to a private school account, this charge may apply. Again, it is not charged on physical cash withdrawals.

There are also cash withdrawal charges linked to the Central Bank of Nigeria cashless policy. When individuals or businesses withdraw cash above approved limits, banks may charge a small processing fee. For example, a petrol station owner withdrawing large sums daily to pay workers in cash may notice extra charges. This is not a tax but a banking policy aimed at reducing heavy cash use and encouraging digital payments.

So why are Nigerians still afraid?

The fear comes from economic pressure and lack of trust. Food prices are high, transport costs keep rising, and electricity supply remains unstable. A worker in Abuja may earn the same salary as last year but spend much more on fuel, rent, and food. In such conditions, even a fifty naira deduction feels painful.

Many Nigerians also do not receive clear explanations from their banks. When deductions appear in transaction alerts without proper breakdown, people assume the government has quietly introduced new taxes. This confusion is worse in rural areas where financial literacy is lower and people rely on word of mouth for information.

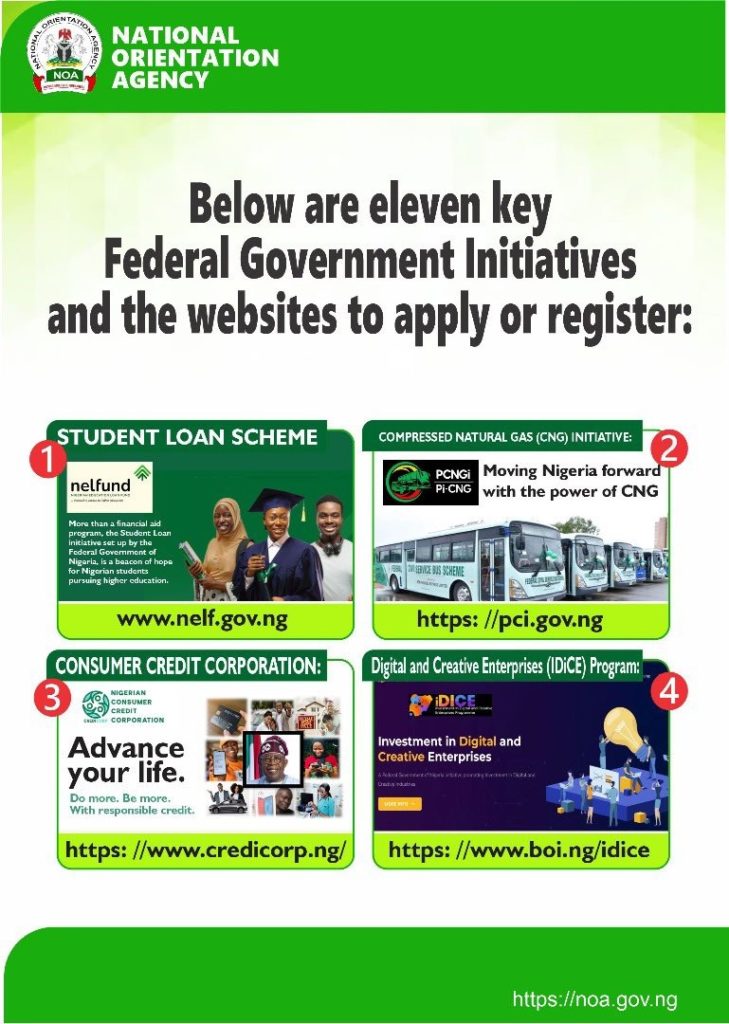

Recent government discussions about tax reform have also increased anxiety. The federal government has said it wants to improve tax collection and reduce dependence on borrowing. While this goal is reasonable, many Nigerians fear that the burden will fall on ordinary people instead of wealthy individuals and large corporations.

Does this situation pose any real risk?

The biggest risk is misinformation. When people believe their money is being unfairly taken, they lose confidence in banks and government institutions. Some traders may return to keeping cash at home, which increases the risk of theft and fire. Others may avoid formal banking entirely.

There is also the reality that repeated small charges affect low income earners more than the rich. A food vendor in Osogbo who makes several small transfers daily may feel these charges more than a high income professional who makes fewer transactions.

However, there are possible benefits if tax reforms are properly handled.

A transparent and fair tax system can help fund better roads, healthcare, schools, and security. Digital transactions also help reduce armed robbery, fraud, and the circulation of fake money. If the government can show clear results from taxes collected, public trust may improve over time.

In conclusion, Nigerians are not currently being taxed simply for withdrawing money from their accounts. The charges people see are mostly existing levies and bank fees that have been poorly explained. The fear many Nigerians feel is understandable given the harsh economic reality, but it is largely driven by confusion rather than new laws.

The responsibility lies on the government and financial institutions to communicate clearly and honestly. Nigerians also need to seek accurate information and ask questions. Only through transparency, fairness, and accountability can tax policies work in the interest of both the government and the people.

- West is a seasoned journalist and development practitioner with over a decade of experience in media, human rights advocacy, and NGO leadership. Her syndicated column, The Wednesday Lens, is published every Wednesday in News Point Nigeria newspaper. She can be reached at bomawest111@gmail.com.