A SWEEPING investigation by the Office of the Auditor-General for the Federation (OAuGF) has uncovered 28 significant financial irregularities involving the Nigerian National Petroleum Company Limited (NNPCL), amounting to over N61.1bn in questionable payments, tax violations, undocumented expenditures, unsubstantiated transfers, abandoned projects, and breaches of procurement laws.

News Point Nigeria reports that the damning revelations are contained in the Auditor-General’s 2022 Annual Report on Non-Compliance (Volume II), which covers transactions executed in the 2021 financial year by NNPCL and its subsidiaries. The report, obtained by our correspondent, has been formally transmitted to the National Assembly for legislative action.

The flagged infractions include N30.1bn, $51.67m, £14.32m, and €5.17m in payments made without approvals, supporting documents, or statutory deductions, raising new concerns about transparency in Nigeria’s most strategic state-owned enterprise.

“These findings highlight systemic weaknesses that continue to expose public funds to avoidable risk,” the Auditor-General’s office said. “Where documents were not provided, payments were unjustified. Where approvals were absent, expenditure breached the law. Recovery and sanctions must follow.”

The latest audit reinforces long-standing concerns about entrenched financial malpractices in NNPCL. Previous Auditor-General reports between 2017 and 2021 had flagged:

N1.33tn (2017)

N681bn (2019)

N151bn + $19.77m (2020)

N514bn (2021), amounting to over N2.68tn and $19.77m in questionable transactions—indicating a persistent pattern of diversion, unsupported transfers, and irregular withdrawals.

One of the most serious issues in the new report concerns £14,322,426.59 spent by NNPC’s London Office without a single document provided to justify the payments.

The funds reportedly covered:

£5.94m – Personnel costs

£1.43m – Fixed contract and essential expenses

£6.94m – Other operational costs

However, auditors said NNPCL failed to present invoices, receipts, schedules, authorisations, payment vouchers, or utilisation details, making verification impossible.

This violates key provisions of the Financial Regulations (2009), particularly:

Paragraph 112 (adequate internal control and documentation)

Paragraph 603(1) (payment vouchers must contain full particulars and supporting documents)

The Auditor-General warned that the absence of records exposes the corporation to high risks of diversion and misappropriation.

NNPC management argued that the London Office operates with an approved budget and maintains detailed records, but blamed the audit query for not specifying which transactions were in question.

The Auditor-General dismissed this as “unsatisfactory,” insisting that the entire £14.3m must be accounted for and fully recovered if documentation remains unavailable.

The report recommended that the GCEO of NNPCL be summoned before the National Assembly’s Public Accounts Committees.

€5.17m, $51.6m, N30.1bn in Additional Irregularities

Beyond the London office, the audit flagged multiple foreign-currency and naira transactions as “irregular,” including:

Foreign currency violations

€5,165,426.26 paid to a contractor with no evidence of engagement (Issue 12)

$22,842,938.28 in unsubstantiated DS/DP settlements (Issue 4)

$12,444,313.22 for generator procurement delayed at Mosimi depot (Issue 24)

$1,801,500 paid under an irregular vessel contract extension (Issue 7)

$2,006,293.20 provisional payments without invoices (Issue 10)

$1,035,132.81 paid to a company without power of attorney (Issue 13)

The audit identified N30,115,474,850.85 in local payment violations, including:

N12.721bn statutory surplus not remitted to the General Reserve Fund (Issue 21)

N3.445bn paid by the CFO without GMD approval (Issue 6)

N2.379bn irregularly paid as status-car cash options (Issue 5)

N1.212bn paid without interim certificates or invoices (Issue 26)

N474.46m spent through unauthorised virement (Issue 9)

N355.43m demurrage on abandoned refinery cargoes (Issue 8)

N292.6m wasted on an A&E hospital project abandoned after mobilisation (Issue 1)

N82.6m undocumented reimbursables

N246.19m paid with no proof of execution (Issue 18)

N46.2m in under-deducted withholding tax (Issue 19)

N6.246bn paid across MDAs without supporting documents (Issue 27)

The report described these as “widespread violation of extant financial regulations.”

Irregular Vessel Substitution Inflated Costs by $1.9m

A major procurement breach involved an irregular substitution of the vessel MT Breeze Stavanger initially contracted at $19,532/day with MT Alizea, billed at $21,643.23/day.

The contractor replaced the vessel without approval, leading to cost inflation of:

Auditors said the substitution directly violated the contract, which required the contractor to replace any rejected vessel at its own expense.

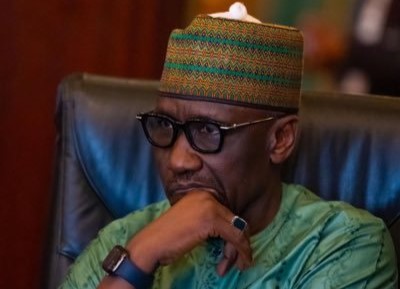

The report notes that the violations took place during the tenure of Mele Kyari, who served as GCEO from 2019 until his removal earlier this year. He was succeeded by Bayo Ojulari.

The Auditor-General’s office has recommended: Immediate recovery of all unsupported payments, remittance of all withheld statutory surpluses and sanctions against officials who failed to account for public funds,

“Where officers fail to provide the required documents, the sums shall be recovered from them directly,” the report warned.