THE Federal Government is poised to receive fresh loan funding from the World Bank, with approval expected for loans totalling $2.25bn on June 13, 2024.

The funding will be received via two major development projects. The first project is the Nigeria Reforms for Economic Stabilization to Enable Transformation Development Policy Financing, which is set to receive $1.5bn.

The second project, NG Accelerating Resource Mobilization Reforms Programme-for-Results, has proposed funding of $750m.

Recall that The PUNCH had indicated that the government might reintroduce previously suspended telecom tax and other fiscal measures in pursuit of securing the $750m loan.

A copy of the plan’s document posted on the World Bank website indicated that the government might reintroduce the excises on telecom services, and EMT levy on electronic money transfers through the Nigerian Banking System among other taxes.

However, the latest information suggests that the administration may have nearly guaranteed the loan.

The Minister of Finance, Wale Edun, at the spring meetings of the International Monetary Fund and the World Bank last month, had announced that the nation had qualified for processing a loan, described as ‘virtually a grant’ of $2.25bn from the World Bank at one per cent interest rate.

According to programme information documents posted on the international lender website, the two projects aim to enhance Nigeria’s economic stability and resource mobilisation capabilities.

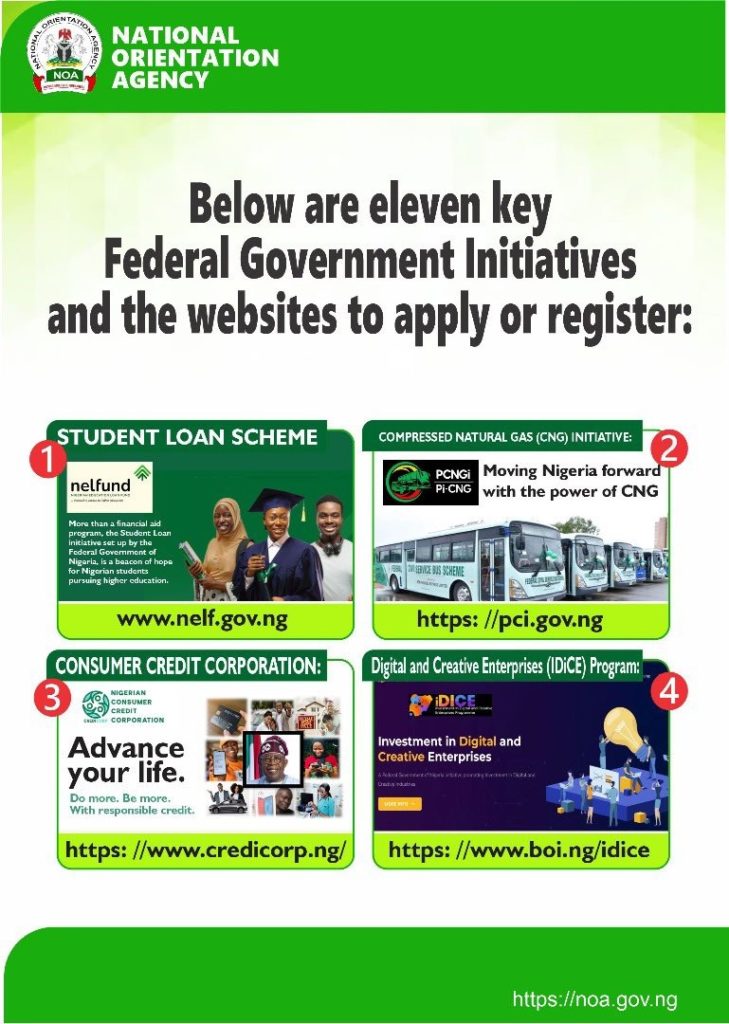

It is expected that the funds will bolster Nigeria’s efforts in reforming economic policies and enhancing government resource mobilisation, essential for the country’s long-term financial sustainability and economic resilience.

The document stated that the primary aim of the PforR programme is to boost non-oil revenues and safeguard oil and gas revenues from 2024 to 2028 at the federal level, emphasising substantial tax, excise, and administrative reforms.

The programme includes three main result areas: implementing tax and excise reforms to increase VAT collections and excise rates on health and environmentally friendly products, strengthening tax and customs administrations to enhance VAT compliance and effectiveness of audits, and safeguarding oil and gas revenues by increasing transparency and net revenue contributions.

The PforR programme includes technical assistance, supporting the Federal Inland Revenue Service and the Nigeria Customs Service to enhance taxpayer and trader compliance.